Sarah Clare Corporandy’s chest clenched with anxiety as the first lockdown orders were issued in her home state of Michigan in March 2020. As a co-founder of Detroit Public Theatre, she wondered how her fledgling theatrical troupe would survive past its fifth birthday without the support of conventional in-person audiences.

As the pandemic dragged on, Corporandy and her team poured their passion and artistic devotion into renovating their own theatrical space, a bold stewardship strategy in a shuttered industry. The gamble to invest heavily in their brick-and-mortar venue more than paid off, Corporandy said. By the start of the 2022-23 season, when the majority of lockdown orders had ended and vaccination rates were climbing, DPT unveiled their new home in downtown Detroit, giving audiences an extra incentive to return. It doesn’t hurt that in addition to DPT’s theatrical productions, the company actively rents out the venue for weddings, family reunions, and community groups.

“When people come into our space, we want them to envision their own event here,” Corporandy said. This type of income has become a vital source of revenue for DPT, she said, illuminating one of the creative solutions that have become keys to survival in the theatre industry.

Earlier this month, Theatre Communications Group (TCG) released Theatre Facts 2023, the latest edition of its in-depth industry report based on data from the TCG Fiscal Survey and SMU DataArts’ Cultural Data Profile (CDP) for the fiscal year completed between Oct. 31, 2022 and Sept. 30, 2023. Written by Rebecca Roscoe, Jen Benoit-Bryan, Daniel Fonner, and Wenhua Di of SMU DataArts, with Rachael Hip-Flores and Corinna Schulenburg of TCG, the report shows the evolution of a still recovering industry. For the first time, Theatre Facts includes a special section focused on analyzing organizations founded by, for, about, with, and near Black, Indigenous, and people of color (BIPOC) communities—also called BITOC (Black, Indigenous, and theatres of color). The annual report gives theatremakers and theatre lovers alike a crucial snapshot of financial, performance, and attendance data for the professional nonprofit theatre field in the United States from three perspectives:

The Universe section offers a broad overview of the U.S. professional nonprofit theatre field in 2022-23, which included an estimated 2,258 organizations.

The Trend Theatres section explores changes over time, with longitudinal analysis of the 137 theatres that participated in either the TCG Fiscal Survey or CDP for the four seasons between 2019 and 2023. Annual expenses over this period ranged from $5,747 to more than $71 million, depending on the size of the theatre.

The Profiled Theatres section provides a nuanced picture of the health of the 213 theatres that completed a CDP in 2023. For this data, theatres are broken into six budget groups, based on annual expenses, from Group 1 (annual expenses of $499,999 or less) to Group 6 (expenses of $10 million or more).

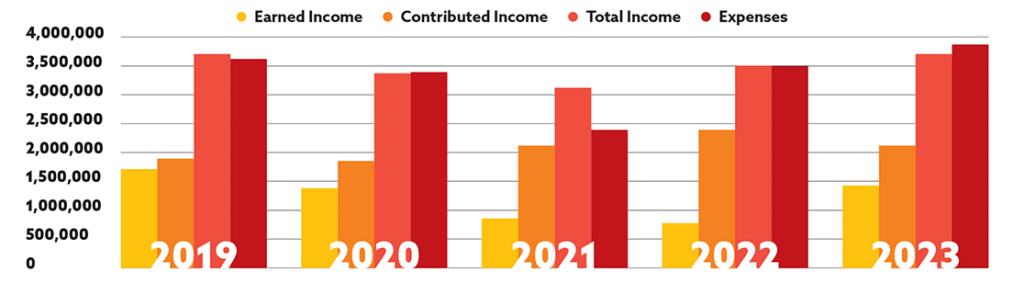

With noticeable drops in contributed income from donors, lagging bottom lines, and expanding operating costs, the industry remains in a state of flux, the report demonstrates. A central takeaway: While trendlines have been steadily and encouragingly improving since the depth of the pandemic shutdowns, none of the indicators show full recovery from pre-pandemic levels. And though the pre-Covid years may look booming in hindsight, many of the issues that have battered the field since 2020 were in fact long-standing and systemic, and are still being worked through.

But if doom and gloom have been the industry tune for the last five years, the report provides some actionable survival strategies for organizations willing to embrace change and implement the lessons of the last several years.

“Theatre Facts 2023 underscores the extraordinary strength of nonprofit theatres in the face of continued challenges,” said Emilya Cachapero, TCG’s co-executive director of national and global programming, in a statement. “While the financial landscape remains uncertain, theatres are innovating and finding new ways to connect with their communities. This important data tells us that we must continue to invest in sustainable solutions that ensure a just and thriving theatre ecology.”

In conjunction with the release of Theatre Facts 2023, we spoke with managing leaders across the country from a diverse group of theatres about what they’re experiencing on the ground.

A Palpable Hit

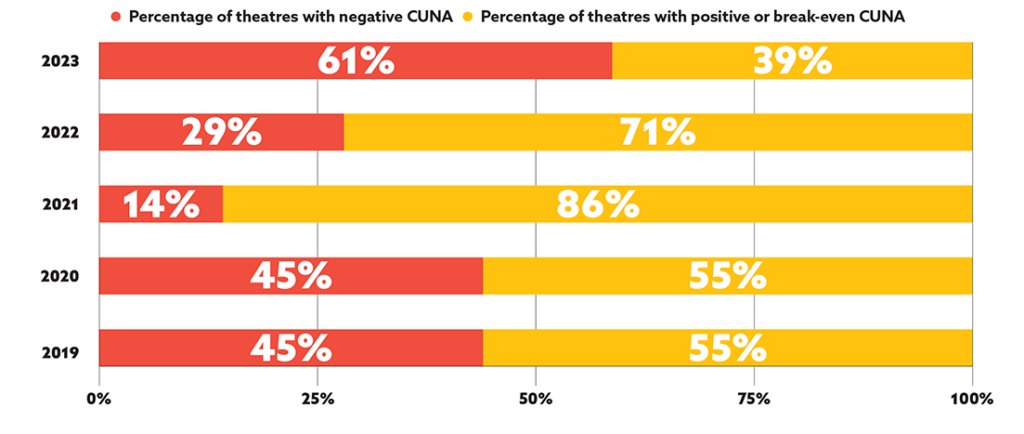

Across the board, the bottom line for theatres has lagged in recent years. For a majority of Trend Theatres in 2023, Theatre Facts reported a negative change in unrestricted net assets (CUNA), an indicator of weak financial health for many theatres, with expenses quickly outpacing income. According to the report, the annual percentage of Trend Theatres ending the fiscal year with break-even or positive CUNA, which indicates that income covered or surpassed expenses, peaked in 2021 (boosted by federal relief funds) before reaching a four-year low in 2023. In 2023, 61 percent of trend theatres reported negative CUNA, with 24 percent seeing negative CUNA that exceeded 20 percent of their budgets—the worst level since Theatre Facts began tracking this information in 2000. The only other time the percentage of negative CUNA topped 60 percent was in 2009, during the height of the Great Recession.

“For the first time in my 12 years here, we have a cash-flow problem,” said Philip Sneed, CEO of the Arvada Center for Arts and Humanities in Colorado.

One of the biggest factors in this dip is the drop in contributed income from top donors, Sneed said, though he is unsure of the cause. “We’ve been seeing flat or declining levels, but we haven’t found one thing to point to,” Sneed said. “We can’t say why this is happening. So far, nobody’s been terribly specific. There’s no one trend we can point to.” (Passage of the bipartisan Charitable Act, which creates new tax incentives for giving to nonprofits, could address this shortfall.)

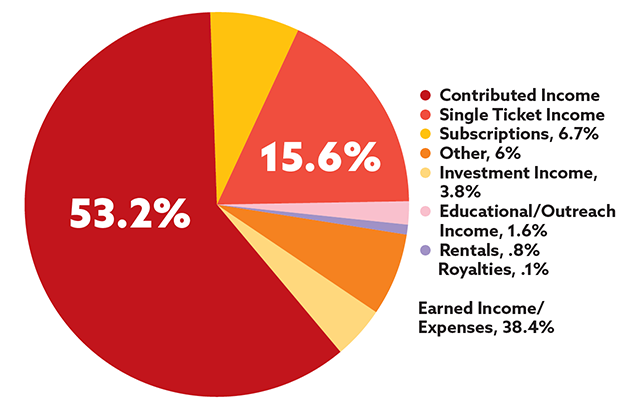

According to the report, average trustee giving for Trend Theatres was 28 percent lower in 2023 than in 2019, declining 15 percent from 2022 to 2023 after peaking in 2020. Similarly, Trend Theatres saw corporate giving decrease by 31 percent and foundation support decline by 12 percent over the trend period, after adjusting for inflation. The report also noted that BITOCs relied more on contributed revenue than non-BITOC organizations. Overall, Trend Theatres saw their total combined earned and contributed income fall by 17 percent over the four-year period.

To combat this trend, Sneed said his organization has taken a bespoke approach when connecting with each major donor. Since no two donors are exactly alike, Sneed said he tries to connect with donors individually in an environment they are likely to be comfortable in, such as at a coffee shop or over an elaborate dinner. He noted that measures to increase donations through one-on-one meetings have gone well so far, but his organization is still feeling the effects of dwindling donorship.

As Theatre Facts puts it, “Donor commitment throughout the pandemic does not seem as strong, and organizations struggle to bring private donations back to 2019 levels when accounting for inflation.”

This has not been the case for every theatre. The report notes that, while major donors contributed less than in previous years, individual contributions rose by 12 percent from 2022 to 2023, a common pattern in times of crisis. Theatre Facts noted similar increases in individual donations in the immediate aftermath of the attacks on Sept. 11, 2001, and during the Great Recession of the late 2000s, signaling that the broader community may be more aware of the financial hardship facing theatres when the whole world is feeling it.

Massachusetts’s Chester Theatre Company, for instance, has seen donations increase since the pandemic, in part due to the recognition of apparent need within the artistic community. “I do feel some of our donors are sensitive to the sense that this is the time to step up,” said Chester Theatre co-artistic director Chris Baker.

Recognition of need has also come in the form of increased donations for Island City Stage in Florida. While artistic director Andy Rogow said that some older patrons were among the last to return in person, in his experience, older audiences remained strong donors. He attributes this to the unique location of Island City and the population of the surrounding community. “We’re an LGBT theatre in the middle of this wealthy gay neighborhood, where a lot of wealthy gay men retire,” Rogow said.

Since the surrounding community has access to expendable income, Rogow said, fundraising has been relatively easy. Throughout the pandemic and its aftermath, Rogow said he never needed to make an urgent call for donations, a rarity in the regional theatre industry.

Subscribe to This

One primary source of financial stability for many theatres is the enduring power of season subscriptions. Despite cataclysmic upheavals in the industry, subscription profitability has remained relatively stable. According to the report, total ticket income for Trend Theatres, encompassing both subscription and single-ticket sales revenue, has increased after a four-year low in 2022. Still, it was 29 percent lower than in 2019 after adjusting for inflation, with non-BITOC organizations reporting ticket income eight percent higher than their BITOC counterparts. Subscription numbers peaked for Trend Theatres in 2020 before hitting an all-time low in 2021, but the report notes that those numbers then increased in both 2022 and 2023, resulting in a one percent increase from 2019.

According to Chester Theatre’s Baker, subscriptions were a lifeline for the western Massachusetts theatre, particularly from longtime subscribers. Baker noted that a small collection of theatre devotees continued to renew their subscriptions, keeping the organization afloat through the 2022-23 season.

“Like everyone else, after Covid we have fewer subscribers than we did before. But that core group stayed,” Baker said. “If that core group drifts, then we would be in trouble.”

Similarly, Serge Seiden, managing director of Mosaic Theater Company in Washington, D.C., noticed a core group of loyal subscribers who are invested in the long-term success of the theatre. Seiden attributes a portion of that devotion to Mosaic’s strong commitment to social justice programming to elevate the themes of Mosaic’s productions far beyond the walls of the theatre. This season, Mosaic is producing Erika Dickerson-Despenza’s cullud wattah, a play about the ongoing water crisis in Flint, Michigan, accompanied by talkbacks featuring local activists. This kind of programming broadens the scope of the production, allows for deep local partnerships, and opens the doors to community engagement, Seiden said. He thinks the role of subscribers is evolving in the industry through efforts to connect with audiences at a deeper, more meaningful level.

“It’s now a very small part of our budget,” Seiden said, but he added, “I do think there is a purpose to subscribers outside of the typical budgeting sense. I think of subscribers much like donors. You need to cultivate those relationships.”

The Arvada Center’s Sneed said his team is taking extra care to accommodate and connect with subscribers, utilizing elaborate data analysis that aims to predict the profitability of a production. “We just try to pull in everything we can think of: age, gender, audience demographics, the production’s history, what comparable theatres are doing,” Sneed said.

During the 2022-23 season, this predictive model accurately forecasted ticket sales for each production within one percent of error. While Sneed admitted that the model wasn’t as accurate for the theatre’s current season, he was quick to state how much it helped with the budgeting process. While the success of a show can often be hit or miss for many theatres, using data is a more reliable way to cater to the taste of subscribers and new audiences alike, Sneed said.

“We have been regaining our audience,” Sneed said. “They’re certainly coming back.”

Though the report notes that attendance was at its highest for Trend Theatres in 2019, falling 22 percent over the four-year trend period, Universe-wide estimates for 2023 show that the 2,200-plus theatres in the nonprofit theatre field attracted more than 27 million audience members, adding over $3.6 billion to the U.S. economy through direct payments for goods and services. Nearly 700,000 Americans subscribed to a theatre season, according to the report. And while places like the Arvada Center saw positive returns on subscriptions, others even saw growth.

“Every year for the past 10 years, our subscriptions have grown,” Detroit Public Theatre’s Corporandy said. “I think that’s in part because we are such a young theatre. This is only our 10th season.”

But subscriptions numbers do not scream rousing success in every quarter. At Florida’s Island City Stage, Rogow said the decline in subscriptions has hit close to home. As a theatre in a demographically older community, who are at a noticeably higher risk for death from Covid-19, Rogow said that his team struggled to get the full complement of subscribers back in seats. For the latest fiscal year covered by Theatre Facts, he said, “We did not have the (same) subscriptions because some people were still hesitant to come back.”

More recently, courtesy of more familiar titles and comforting themes, Rogow said that subscriptions and single-ticket sales are just about where they were pre-Covid. “Our audience came roaring back,” Rogow said. “People are hungry for good drama, good stories, good connections.”

For the foreseeable future, Rogow said his team is focusing on “small-scale, intimate theatre and new works” to attract more audiences.

The Labor Crunch

Since theatres started reopening their doors following the pandemic-induced closures, Theatre Facts noted that expenses have risen substantially and continued to increase. Though total earned income for Trend Theatres increased 94 percent from 2022 to 2023, that earned income still remained lower than in 2019, resulting in earned income covering less of a theatre’s total expenses in 2023 than it did in 2019.

“Everything is so much more expensive now,” said Chester Theatre’s Baker, echoing thoughts from theatres across the country that are seeing a national rise in prices for basic set construction materials.

Lumber, housing costs, and aging capital have caused issues for the intimate Massachusetts theatre. Similarly, Island City has struggled to keep up with skyrocketing production costs, with set budgets ballooning from $5,000 per play to roughly $25,000 per play, Rogow said, and the costs for musicals often stretching above $100,000 per production. He attributed this jump primarily to the cost of lumber in the years following the Covid lockdowns, which spiked due to supply and labor constraints, coupled with increased demand for home improvements.

The rapid price hike was quickly passed on to consumers, sparking lumber shortages and supply chain issues felt by production crews nationwide. So, though Arvada Center has seen a 10 percent increase in revenue since 2019, Sneed said, they’ve also seen a 25 percent increase in costs, a noticeable portion of which can be attributed to inflation.

While theatres have demonstrated resilience through increased earned and contributed income compared to the immediate aftermath of the pandemic, the Theatre Facts report states, these financial improvements haven’t been able to outpace rising costs.

“As the cost of things goes up, the conventional wisdom says, how long can we keep doing this?” Baker said. “The whole operation shifted because everything had to be done differently.”

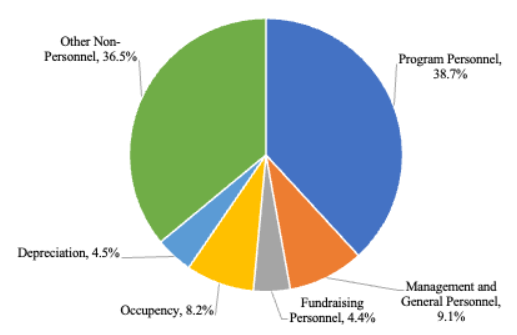

The largest portion of increased expenses for many theatres, though, is not supplies but personnel. According to Theatre Facts, Profiled Theatres saw total payroll expenses comprise about 45 to 53 percent of total expenses across all theatre budget sizes. Multiple theatres stated that management reevaluated salaries during this period and significantly adjusted pay rates upward for many craftspeople and artists.

“That’s hard in an industry that is built on everyone making sacrifices,” said Corporandy of Detroit Public Theatre.

In the early years of her career, Corporandy, like many theatre professionals, held to an unwavering “the show must go on” mentality. For her, this meant working long hours for minimal pay with limited opportunities for a well-balanced personal life. The pandemic closures of 2020 instigated an overdue industry-wide discussion about work-life balance and increased pay.

“We want to support staff with salaries at a living wage level,” said Seiden of Washington, D.C.’s Mosaic Theater. Added Corporandy, “It’s not perfect, but it is always a priority.”

Indeed, while the pressure around compensation is coming not only from a tight labor market but a new wave of union organizing, it is also a priority of many managers. Corporandy and her peers insist that theatre artists and administrators be compensated fairly and fully for their work.

“As we become the most professional theatre we can be,” Rogow said, “we have to pay for that quality.”

Dark and Darker

For many regional nonprofit theatres, the post-lockdown years were a mark of their durability, allowing industry survivors to celebrate their adaptability. But if the pandemic and recovery era are viewed in retrospect as dark days, an even bigger and more uncertain financial storm cloud is rumbling toward the industry (as it is toward all industries).

Several theatres interviewed for this piece discussed problems looming on the horizon for regional theatres, including general economic instability and the Trump administration’s erratic handling of federal grants. During his first weeks in office, the president attempted to freeze spending on all federal grants, and in subsequent weeks his executive orders targeting “DEI” and “gender ideology” were tacked on to application guidelines for the National Endowment for the Arts, imperiling that funding for many theatres. Those executive orders have all been challenged, but the forecast for federal spending on the arts remains opaque.

“Some percentage of your brain is focused on keeping up with all that and not on the already challenging work,” Seiden said. “We’re just in chaos land, and it’s unnerving.”

For theatres to survive the next wave of industry turmoil, the report suggests taking to heart some key lessons of the pandemic shutdown years.

“Theatre Facts 2023 highlights the critical need for bold, innovative leadership to navigate these challenges and seize opportunities in a rapidly changing landscape,” the report states. “By embracing adaptability and community engagement, theatres can position themselves for a more resilient and equitable future, continuing to serve as vibrant cultural touchstones in their communities and beyond.”

Colleen Hammond is an arts journalist and theatre artist based in Pittsburgh. She covered the criminal justice system for The News & Observer in Raleigh, North Carolina, and is an inaugural fellow with Critical Insight, a generative arts journalism fellowship with the Pittsburgh Public Theater and American Theatre.

Support American Theatre: a just and thriving theatre ecology begins with information for all. Please join us in this mission by joining TCG, which entitles you to copies of our quarterly print magazine and helps support a long legacy of quality nonprofit arts journalism.

Related

Leadership Change at the Top of Chautauqua Theater Company

Both artistic director Andrew Borba and managing director Sarah Clare Corporandy will step down in 2022.

In "Entrances & Exits"

Detroit Public Theatre Gets In on an Urban Arts Renaissance

Founded by a trio of female directors, Motor City's newest theatre company plans to produce new plays that reflect the city's own story of struggle and rebirth.

In "Great Lakes"

Detroit Public Theatre Names Dominique Morisseau Exec Artistic Producer

The Detroit native, a founding board member of the company, has joined the leadership team.

In "Entrances & Exits"