Among the many questions that hang over the eventual reopening of the U.S. economy and of the businesses that power it are whether customers will return, and if so how quickly, to pre-pandemic levels of consumption. Restaurants and retailers who have already partially reopened in some U.S. states are getting some early answers: While many customers are eager to come back, most are wary, and with good reason.

They are especially wary of enclosed spaces that involve close or prolonged contact with other people, and this emphatically includes theatres, concert venues, and other live event sites. This profound reluctance is newly confirmed in studies by two research firms tracking the willingness of arts patrons to return to cultural programming. Shugoll Research, which earlier released a survey of D.C. area theatregoers, recently conducted a study of theatregoers in New York City, and another of theatregoers nationwide, which show that well less than half (41 percent) of regular NYC theatregoers, and only a little more than a third (36 percent) of theatregoers nationwide, say they plan to return to their previous theatregoing habits when theatres reopen, with the vast majority opting to wait between three and six months before attending plays again. Meanwhile tracking surveys from Colleen Dilenschneider of IMPACTS Research & Development, which compare willingness to return to different kinds of cultural activities, show a consistent hesitation to return to live theatres vs., say, public parks or museums.

Shugoll’s studies seem to show that New York theatre fans are slightly more loyal (or foolhardy) than their counterparts nationwide—i.e., slightly more of them say they are “very likely” to return when theatres open, at 41 percent compared to 31 percent in the D.C.-area survey, and 36 percent nationwide. And the number who say they’ll attend immediately if there’s something they want to see is slightly higher among New York theatregoers than the national number (21 vs. 18 percent), though curiously not the D.C. number (25 percent).

Most of Shugoll’s other findings are discouraging, with nearly 63 percent of theatregoers nationwide saying they’d wait a few months or more before returning after theatres reopen (the number is 58 percent in NYC and 49 percent in D.C.), and 29 percent of theatregoers nationwide saying they’d wait as long as six months. One crucial demographic even sounds hesitant to return at all, or at least for an entire theatre season: Only 21 percent of respondents 55 and older—a key theatregoing population, and also the group most vulnerable to the coronavirus—say they are very likely to return to theatregoing in the coming season, while about the same percentage, 23 percent, count themselves very unlikely to return. Some in this age cohort do plan to return, but again, not soon—45 percent think they will wait six months or more before coming back, at which point they say they are much more likely to cut back the frequency of attending (45 percent) than increase it (11 percent).

A tiny bright spot: Frequent theatregoers, those who attend four times a year or more, show durable loyalty in the nationwide study. Forty-one percent say they plan to go to the theatre more after reopening than they did before, compared to 28 percent who say they’ll go less often, and 48 percent of frequent attendees consider themselves “very likely” to return when theatres reopen. Even this loyal cohort, though, will take a “wait and see” attitude, with 57 percent saying they’d hold off for a few months or more, and 25 percent a full six months, before attending.

Dilenschneider’s findings have the benefit of showing trend lines, as she has been tracking national respondents since March 24. The news for theatres here is not rosy: While respondents show gradually growing interest in returning to parks, beaches, museums, even sporting events, interest in performing arts attendance has ticked down in her survey. As she puts it on her blog Know Your Own Bone, “Cultural experiences that allow for a visitor’s relative freedom of movement, particularly those featuring outdoor spaces, will likely benefit from increased demand upon reopening. This category of experiences includes outdoor historic sites, parks, zoos, botanic gardens, etc. This stands to reason, as people may feel confident that—especially with operational adaptations for safety—attendees may be able to adhere to social distancing practices while still enjoying these experiences. Experiences involving enclosed spaces with minimal visitor movement—such as performing arts enterprises—indicate lessened demand. This may indicate apprehension around remaining stationary in a confined or enclosed space with many other people while the coronavirus is still spreading and no vaccine is yet available.”

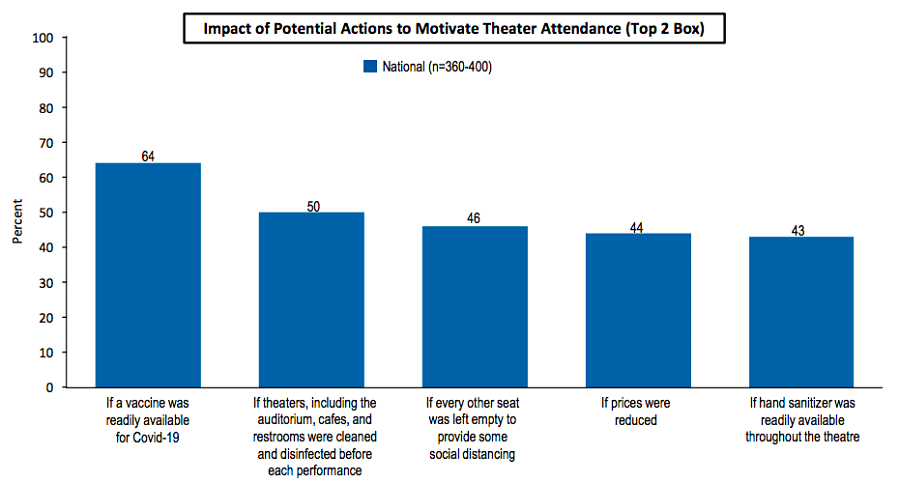

Indeed, both Shugoll and Dilenschneider’s studies polled respondents on what would make them feel comfortable about returning, and the leading factor by far is the availability of a coronavirus vaccine: 87.9 percent of Dilenschneider’s respondents rank that as their highest priority for a return, while Shugoll’s national study puts that number at 64 percent and his New York City study at 73 percent. As Mark Shugoll pointed out, the development of a vaccine is “well beyond the control of theatres,” but among the things theatres can control, his national respondents ranked other measures highly: cleaning and disinfecting before each performance (50 percent), roping off every other seat to allow for social distancing (46 percent), having hand sanitizers available throughout the theatre (43 percent), having face masks available (43 percent), requiring all in the audience to wear face masks (41 percent), and requiring everyone’s temperature to be taken at the door before entrance (39 percent). And though his respondents showed more anxiety about health safety than economic concerns, 44 percent also said that lower prices would be a further enticement. “This suggests the possibility of a ‘welcome back’ sale to trigger revenues, perhaps coordinated by the appropriate industry associations,” Shugoll suggested.

Dilenschneider’s numbers track behavioral and official influence, with 65.2 percent of her respondents saying that governmental edicts lifting travel and business bans would be a factor in their decision to return, and 59.9 percent saying that “seeing others visit” would also be persuasive.

Indeed, if businesses open up over the next few months without huge flareups in COVID-19, and/or if testing and tracing can be widely implemented—both big ifs, even pipe dreams, according to most health experts—it is possible that theatregoers’ attitudes about gathering will change. As Shugoll conceded, “The data in this study are very much impacted by the point in time it was conducted. As the pandemic progresses, views likely will change.” These surveys are “snapshots,” he added. “The world’s going to change, and it’s changing so fast.”

Full copies of each of the Shugoll Research reports are available at http://unbouncepages.com/shugollresearch/