COLORADO SPRINGS, COLO.: TRG Arts and U.K. arts data specialists Purple Seven have released their September COVID-19 Sector Benchmark Insight Report, which examines the impact of COVID-19 on ticket sales in North America and the U.K. in the six months since venues closed in March. This new study shows that while ticket sales and revenue have decidedly declined in the last half year, there remains potential for a brighter spring 2021.

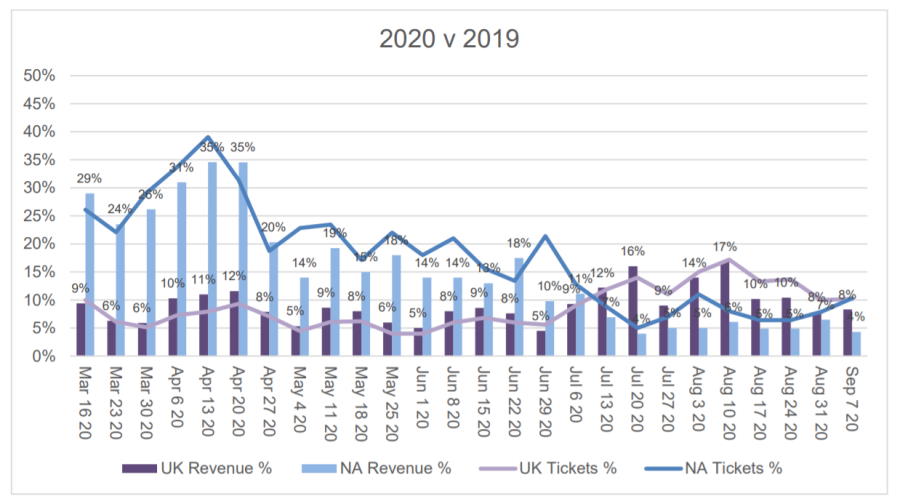

The study examines data from box office feeds of 288 commercial and nonprofit venues of all scales in the U.S., Canada, and the U.K. The report reveals that, in the period from March 16 to Sept. 15 in North America, ticket sales in fell by 83 percent and box office income fell by 84 percent compared to the same period in 2019. Most concerning: The downward trend has only worsened across the six-month period, with sales in August and September bringing in only a third of what was earned in March and April. On top of that, the report shows that income from individual giving has fallen by 24 percent, even as the number of gifts made has risen.

On the other hand, the study also revealed that, for the period from Dec. 1 to Aug. 31, 2021 in North America, advance ticket sales and revenues are 67 percent and 89 percent of their 2019 levels, respectively. The report attributes the strong performance of long-term advances to the rescheduling of shows from 2020 to 2021. In a release, TRG Arts and Purple Seven caution that this hope for a rebound in 2021 will only remain if organizations can open without social distancing and return to confidently marketing these productions to build on these advance sales.

“While it is heartening to see encouraging advances for the spring and summer, unless daily sales rapidly return to historic levels the positive gap will diminish,” said Purple Seven CEO Stuart Nicolle in a statement. “If venues can open without social distancing by that point and cultural organizations start immediately investing in marketing these shows, there is a chance that the bounceback could be remarkably swift. However, with organizations making understandably risk-averse marketing investment decisions due to continued uncertainty regarding their ability to open—with or without social distancing measures—long-term advances are increasingly likely to look less healthy.”

In the U.K., the findings show that in the six-month period of March 16 to Sept. 15, ticket sales and box office income fell by 92 percent and 91 percent, respectively, compared to the same period in 2019. During the six months, sales increased throughout July and into the middle of August, but that recovery was brief, with recent sales returning to the average for the six-month period. Similarly to North America, the report shows that U.K. advance ticket sales and revenues are 75 percent and 85 percent of 2019 levels for the period of Dec. 1 to Aug. 31, 2021. Meanwhile the U.K.’s decline in contributed income is even more stark that North America, with gifts given falling by 46 percent and cumulative philanthropic revenue falling by 63 percent. The report mostly attributes this to the decline in gifts over £10,000.

“In the coming weeks TRG Arts and Purple Seven will follow up on these findings with examples of organizations that are bucking the trend and delivering significantly greater tickets sales or philanthropic revenue than their peers,” said TRG CEO Jill Robinson in a statement. “From our analysis of this diverse group of ‘overperforming’ organizations, there is a clear and unsurprising similarity: They are all either proactively fundraising or promoting ticketed events, both digital and live, that they have on sale.”

In release the companies say they will continue to publish studies on a monthly basis as they continue to track the impact of the pandemic on the arts. Previous insight reports, including the full September report, can be found on the TRG Arts website.